Listen up,

yoga teachers!

Meet your new favorite podcast.

It's like YTT sharing circle meets

yoga business school.

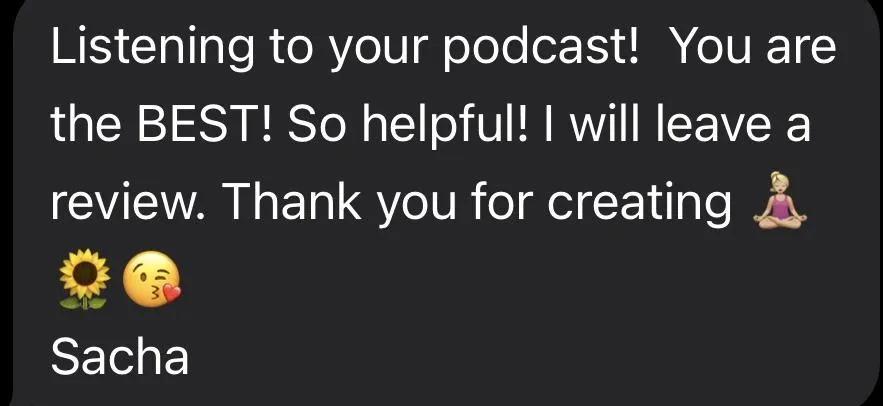

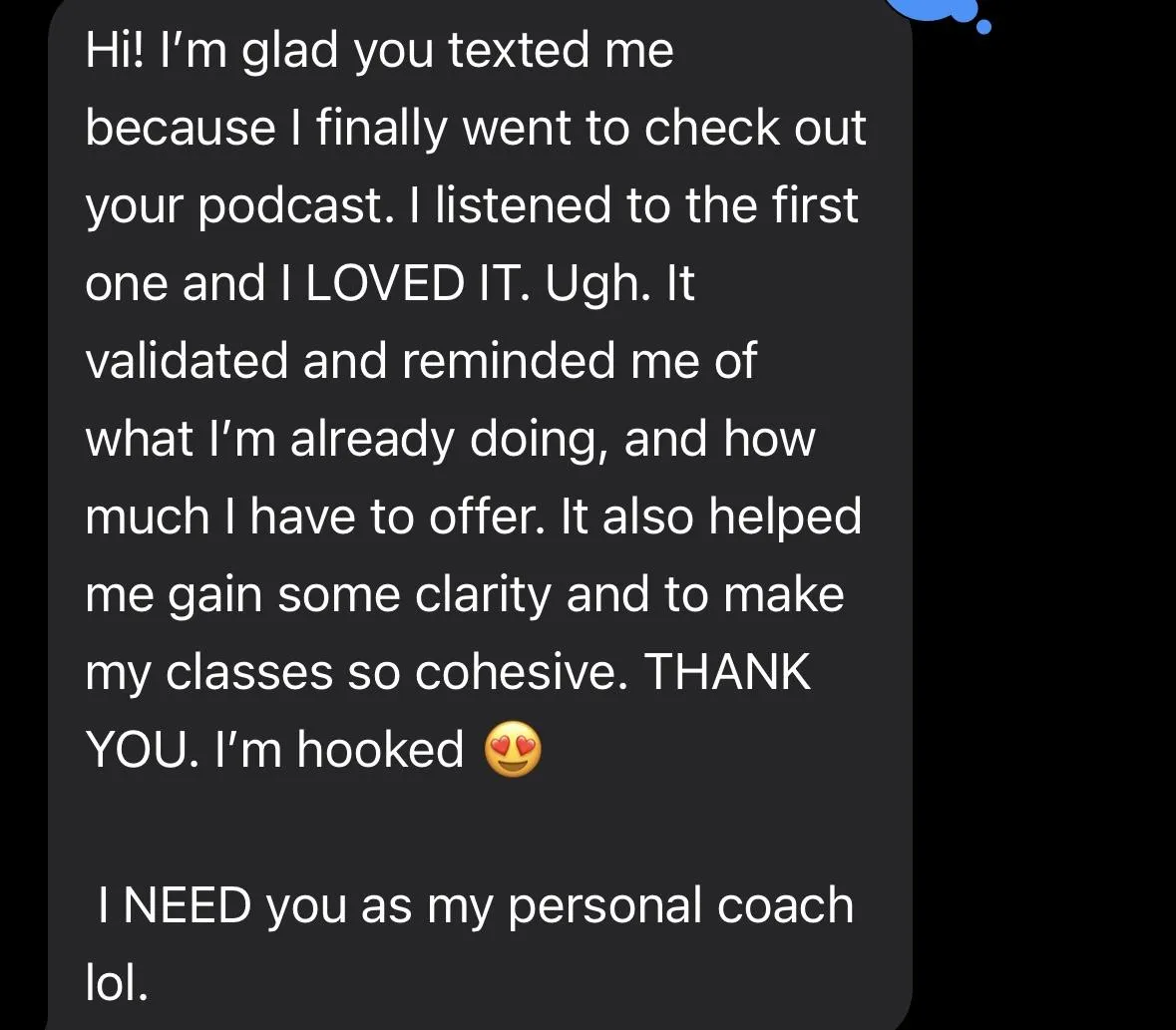

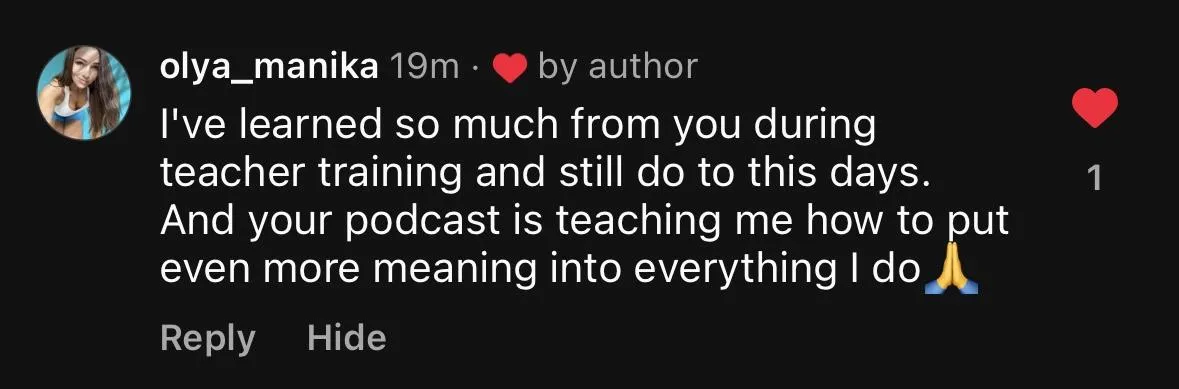

What People Are Saying About The Podcast

All The Latest Links

Here are all the links you need to tune in, subscribe/follow, and leave a review for Master Your Yoga Teaching, as well as join our community and check out resources talked about on the podcast!

Find Out What MYYT Can Do For You!

Snag my free resource 8 Steps to Master Your Yoga Teaching to level up your skill today!

On Social

Let's Connect